Help Available for Visually Impaired to Navigate Tax Season

Tax day is April 15. This time of the year can be stressful for anyone, but for individuals who are blind or visually impaired, it can be challenging. The process can feel overwhelming, from gathering documents to completing forms, and ensuring that information is entered correctly. However, with proper preparation and the right resources, filing taxes can be manageable, reducing stress and creating a sense of independence.

If you found yourself scrambling this year to find documents and print out forms, make a note to start earlier for next tax season! Avoid the stress of last-minute filing by starting early and setting aside dedicated time to work on your taxes. Waiting until the last minute leads to rushing and unnecessary worrying and can often cause mistakes in preparation.

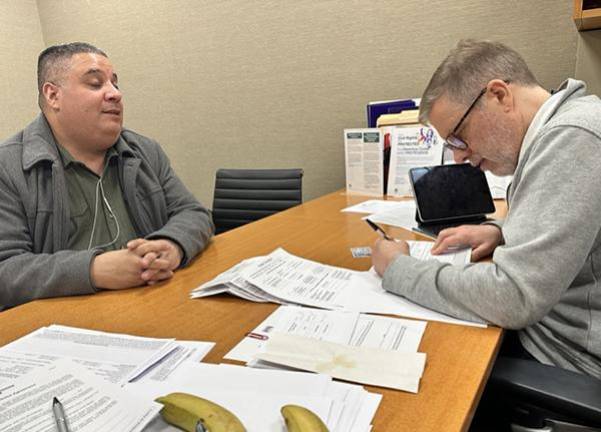

One resource available to individuals who are blind or visually impaired is Lighthouse Guild’s Tax Preparation Program. Dorothy Delayo, who has been volunteering in this program for the past three years, offers useful tax filing tips:

Organization is Key

Start by gathering all necessary documents, such as income statements, receipts, and tax forms, and organizing them in a way that is easy to keep track of. Assistive technology such as electronic magnifiers can help identify different documents. If you’re not sure if a specific document will be necessary, bring it anyway. It’s better to have too many documents than not enough. Stay on top of records and finances all year, rather than waiting until filing season. Keep your information in a safe and secure location that’s easy to access. Your ID card and social security card are necessary for filing as well.

Find Trustworthy Resources

One of the most important aspects of utilizing a tax preparation resource is feeling comfortable with the person handling your sensitive financial information. Seek out organizations that specialize in working with people who are blind or visually impaired. Places such as Lighthouse Guild are not only able to help scan documents to ease the process of filing taxes, but they are also more equipped to work with specific unique situations that other financial institutions might not have experienced in the past. Preparers at these types of institutions are more inclined to go through all documents slowly, answer questions to the best of their knowledge, and ask the right questions to help ensure information is accurate and accounted for.

Make a Plan

If you found yourself scrambling this year to find documents and print out forms, make a note to start earlier for next tax season! Avoid the stress of last-minute filing by starting early and setting aside dedicated time to work on your taxes. Waiting until the last minute leads to rushing and unnecessary worrying and can often cause mistakes in preparation. If you plan on submitting medical records, keep a list of receipts throughout the year and set aside time to go through each expense. Slowly and carefully create a list of necessary documents, including identification information, financial statements, tax forms, and pay stubs. Before meeting in person, go through this list several times. Don’t hesitate to reach out to preparers beforehand to ask any clarifying questions.

By following these steps and utilizing available resources, individuals who are blind or visually impaired can successfully navigate tax season with confidence. Remember that you are not alone – support and assistance are available to help you through the process. Keeping a level head, slowing down, and calmly working through potential hurdles will ensure that forms are completed correctly and on time.

Jeremy Morak is a Marketing Manager at Lighthouse Guild. Dorothy Delayo is a volunteer at Lighthouse Guild.